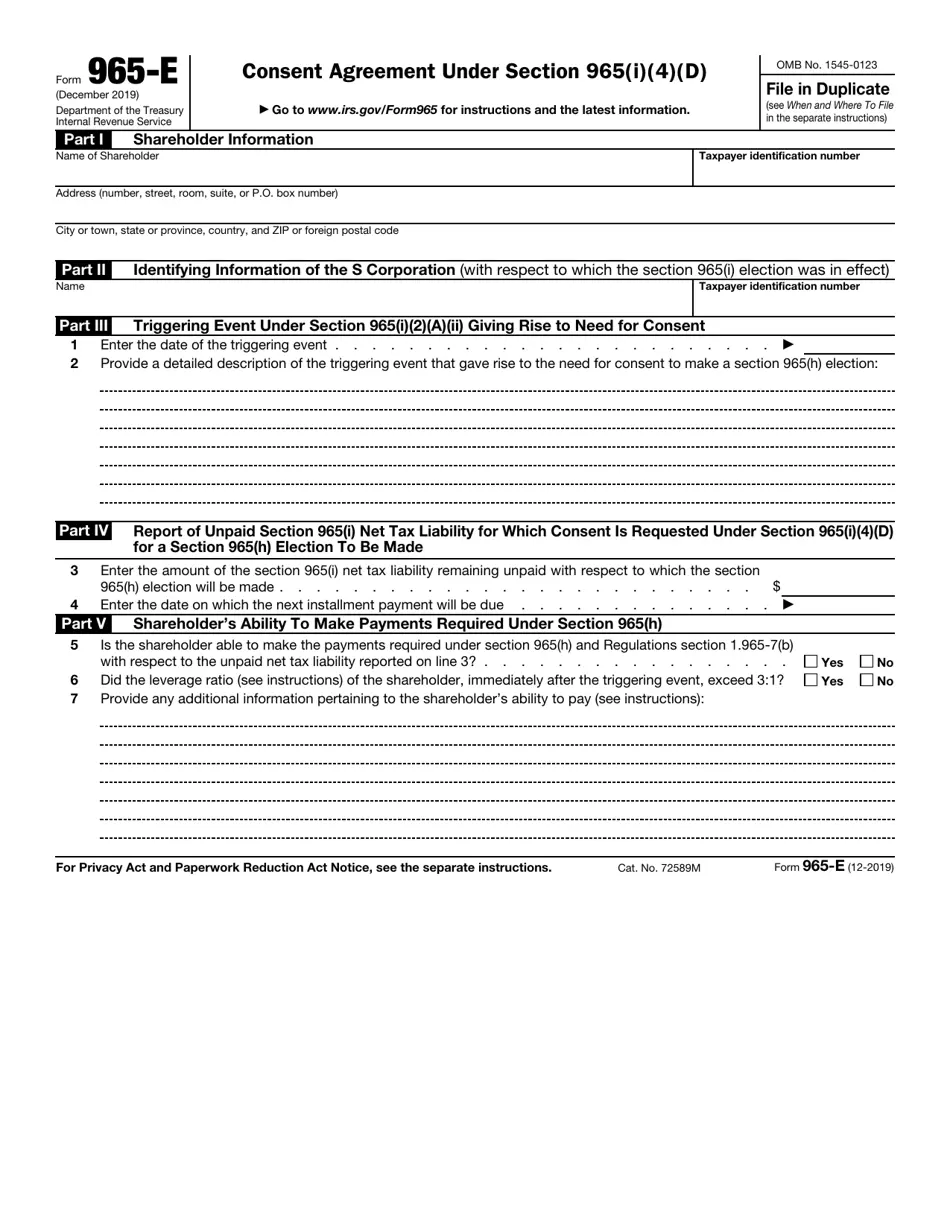

Instructions for Form 965-E (12/2019) Consent Agreement Under Section 965(i)(4)(D) Section references are to the Internal Revenue Code unless otherwise noted.

Revised: 12/2019

Guidelines for Form 965-E – Introduction Future Changes For the most up-to-date information on developments related to Form 965-E and its instructions, including post-publication legislative changes, please visit IRS.gov/Form965E.

Background On December 22, 2017, section 965 of the Internal Revenue Code (section 965) underwent modifications. Following this amendment, certain taxpayers are obliged to declare a portion of their accumulated post-1986 deferred foreign income from specified foreign corporations (specified foreign corporations) they own directly or indirectly through other entities as income, known as the section 965(a) inclusion amount.

Taxpayers who are shareholders in S corporations may have a section 965(a) inclusion amount due to their ownership of deferred foreign income corporations (DFICs) through S corporations that are themselves U.S. shareholders of the DFICs. If a taxpayer is a shareholder in an S corporation that is a U.S. shareholder of a DFIC and has a section 965(i) net tax liability (as defined later in these instructions) concerning the S corporation, they may opt for a deferral election under section 965(i) (section 965(i) election). The shareholder’s section 965(i) net tax liability with respect to an S corporation is calculated on an individual S corporation basis, and the section 965(i) election is made on a per S corporation and per shareholder basis. A section 965(i) election allows a shareholder in an S corporation to delay payment of their section 965(i) net tax liability until a triggering event takes place. Moreover, when a triggering event occurs, the shareholder can then choose to pay the section 965(i) net tax liability in installments over 8 years through an election under section 965(h) (section 965(h) election). However, if the triggering event involves a liquidation, sale, exchange, or substantial asset disposition of the S corporation, a cessation of business by the S corporation, or the S corporation ceasing to exist, the shareholder must obtain the Commissioner’s consent to proceed with the section 965(h) election.

General Instructions

Definitions

- Section 965(i) Net Tax Liability: The excess, if any, of the S corporation shareholder’s net income tax for the tax year in which the S corporation shareholder includes a section 965(a) inclusion in income, calculated as if the only section 965(a) inclusions included in the shareholder’s income are domestic pass-through entity shares of section 965(a) inclusions by the S corporation related to DFICs of which the S corporation is a U.S. shareholder. This calculation excludes any income, deduction, or credit attributable to a dividend received (directly or through a chain of ownership described in section 958(a)) by the S corporation from, or an inclusion under sections 951(a)(1)(B) and 956 with respect to, a DFIC and paid during, or included with respect to, the DFIC’s inclusion year.

- Section 965(i)(2)(A)(ii) Triggering Event: The liquidation, sale, exchange, or other disposition of substantially all of the assets of the S corporation (including in a title 11 or similar case), the cessation of business of the S corporation, or the S corporation ceasing to exist.

Purpose of the Form Form 965-E is intended for use by an S corporation shareholder who has an outstanding section 965(i) net tax liability and has experienced a section 965(i)(2)(A)(ii) triggering event. This form helps obtain consent to make a section 965(h) election, as required by section 965(i)(4)(D) and Regulations section 1.965-7(c)(3)(v)(D)(1).

This form seeks the necessary information and representations to meet the requirements of Regulations section 1.965-7(c)(3)(v)(D)(1) to enter into a consent agreement under section 965(i)(4)(D). If the shareholder completes and files Form 965-E accurately following these instructions, they will be deemed to have properly obtained consent under section 965(i)(4)(D). Nevertheless, the Commissioner may review the consent agreement and request additional information or pose further inquiries, particularly regarding the shareholder’s ability to make payments required under section 965(h) concerning the outstanding section 965(i) net tax liability covered by the consent agreement. If the Commissioner finds a material misrepresentation or omission in the consent agreement, or if the requested additional information is not provided within a reasonable timeframe (as communicated by the Commissioner), the consent agreement may be rejected retroactively to the date of the triggering event. If rejected, the entire amount of the section 965(i) net tax liability with respect to the triggering event becomes due and payable for the year the triggering event occurred.

Form 965-E is exclusively the consent agreement under section 965(i)(4)(D) as mandated by Regulations section 1.965-7(c)(3)(v)(D)(1). It does not include the section 965(h) election, which requires a separate submission in line with the requirements specified in Regulations section 1.965-7(c)(3)(v)(b)(2). Failure to properly make the section 965(h) election will entail the full payment of the section 965(i) net tax liability with respect to the triggering event for the year it transpired.

Who Needs to Submit An S corporation shareholder with an outstanding section 965(i) net tax liability, following a section 965(i)(2)(A)(ii) triggering event, must file Form 965-E to obtain consent for a section 965(h) election.

Note: Each shareholder must file their own Form 965-E to secure consent for a section 965(h) election. Each shareholder is also responsible for making their own section 965(h) election. An S corporation cannot submit Form 965-E or make section 965(h) elections on behalf of its shareholders.

When and Where to File The original Form 965-E must be mailed to the IRS’s Memphis Compliance Service Collection Operations at the provided address within 30 days of the section 965(i)(2)(A)(ii) triggering event.

Memphis CSCO 5333 Getwell Road MS 81 Memphis, TN 38118

Additionally, a duplicate copy of Form 965-E must be attached to the shareholder’s tax return for the tax year in which the section 965(i)(2)(A)(ii) triggering event occurred, filed by the due date (considering any extensions) for such return.

Form 965-E is considered timely filed only if submitted within 30 days from the date of the section 965(i)(2)(A)(ii) triggering event. No extensions will be granted for filing Form 965-E, and relief is not available under Regulations section 301.9100-2 or 301.9100-3 to file a late consent agreement.

Specific Instructions

Part I — Shareholder Information

- Use Part I to furnish the identifying details of the shareholder seeking consent for the section 965(h) election. Provide the shareholder’s complete legal name, taxpayer identification number,